Payment Processing

Interest Calculation

Interest calculation to be paid on net forgiveness amount:

• 1% - defaults to simple interest unless lender indicates compounded interest was used.

• Please note, the Forgiveness platform has been updated to honor the Bank Method as a default method for interest calculation: All interest calculated under this platform shall be computed based on 365(Actual)/360-day count by default

• The platform also supports interest calculation based on 365(Actual)/365-day count, 30/360-day count as well. Lender AO would have to choose this option in Institution Settings on Forgiveness SBA portal

Formula for Interest Calculation (Actual/360)

((SBA calculated Forgiveness amount – Loan increase amount) * 1/100 * (Payment Date – Loan Disbursement Date)/360) +

(Loan increase amount * 1/100 * (Payment Date – Loan increase Disbursement Date)/360)

Example (Actual/360)

| SBA Number | Forgiveness Amount (determined by SBA) | Loan Disbursement Date | Loan increase amount (if any) | Loan increase disbursement date | Payment Date | Interest Calculated @ 1% | Final forgive amount with interest |

|---|---|---|---|---|---|---|---|

| X | 300,000 | 05/08/2020 | 0 | N/A | 09/30/2020 | 1208.33 | 301,208.33 |

| Y | 300,000 | 05/08/2020 | 9000 | 06/01/2020 | 09/30/2020 | 1202.33 | 301,202.33 |

Formula for Interest Calculation (Actual/365)

((SBA calculated Forgiveness amount – Loan increase amount) * 1/100 * (Payment Date – Loan Disbursement Date)/365) +

(Loan increase amount * 1/100 * (Payment Date – Loan increase Disbursement Date)/365)

Example (Actual/365)

| SBA Number | Forgiveness Amount (determined by SBA) | Loan Disbursement Date | Loan increase amount (if any) | Loan increase disbursement date | Payment Date | Interest Calculated @ 1% | Final forgive amount with interest |

|---|---|---|---|---|---|---|---|

| X | 300,000 | 05/08/2020 | 0 | N/A | 09/30/2020 | 1191.78 | 301,191.78 |

| Y | 300,000 | 05/08/2020 | 9000 | 06/01/2020 | 09/30/2020 | 1185.86 | 301,185.86 |

Formula for Interest Calculation (30/360)

(SBA calculated Forgiveness amount – Loan increase amount ) * 1/100 * yearfrac on basis 0(Payment Date – Loan Disbursement Date)/360 +

(Loan increase amount * 1/100 * yearfrac on basis 0(Payment Date – Loan increase Disbursement Date)/360)

Example (30/360)

| SBA Number | Forgiveness Amount (determined by SBA) | Loan Disbursement Date | Loan increase amount (if any) | Loan increase disbursement date | Payment Date | Interest Calculated @ 1% | Final forgive amount with interest |

|---|---|---|---|---|---|---|---|

| X | 300,000 | 05/08/2020 | 0 | N/A | 09/30/2020 | 1183.33 | 301,183.33 |

| Y | 300,000 | 05/08/2020 | 9000 | 06/01/2020 | 09/30/2020 | 1177.58 | 301,177.58 |

Overpayment

SBA has determined that it is not cost effective to require Lenders to return forgiveness overpayments of $10 or less and, accordingly, Lenders need not return the funds to SBA if the amount of the overpayment with respect to a particular PPP loan is $10 or less. In such cases, instead of returning the overpayment to SBA, the Lender must credit any remaining balance on the PPP loan for which the overpayment was made by the amount of the overpayment. If there is no remaining balance, the Lender may retain the overpayment.

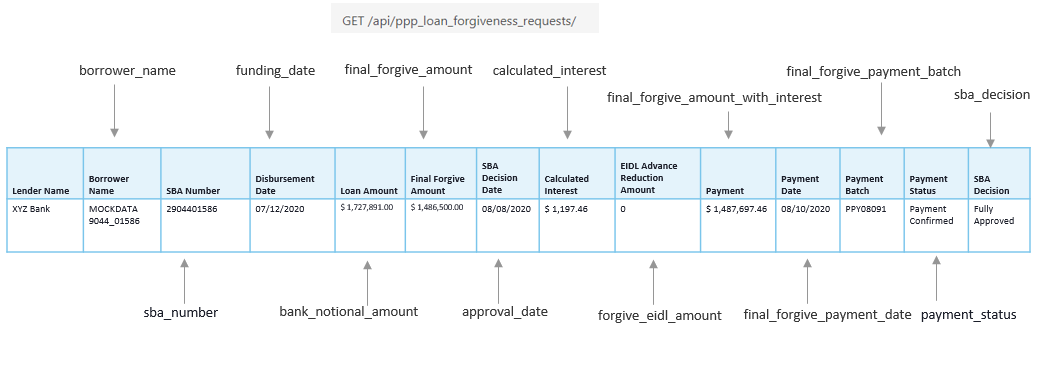

Payment Dashboard to API Mapping

The Payment Dashboard will display details only when SBA takes the decision on the forgiveness

Please note: EIDL advance reduction amount will always be from SBA system of records on payment dashboard.

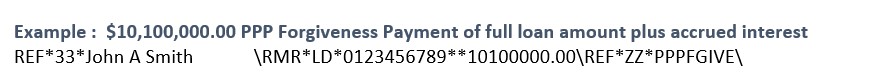

CCD+ ACH 7 Record Addendum Layout for PPP Forgiveness Payment

| Field Name | Value | Length | Character Position |

|---|---|---|---|

| Segment Identifier | REF | 3 | 01-03 |

| Separator | * | 1 | 04-04 |

| Reference Number Qualifier | 33 | 2 | 05-06 |

| Separator | * | 1 | 07-07 |

| Borrower Name | (Up to 25 Positions Left Justified) | 25 | 08-32 |

| Terminator | \ | 1 | 33-33 |

| Segment Identifier | RMR | 3 | 34-36 |

| Separator | * | 1 | 37-37 |

| Reference Number Qualifier | LD | 2 | 38-39 |

| Separator | * | 1 | 40-40 |

| SBA Loan Number | ########## | 10 | 41-50 |

| Separator | ** | 2 | 51-52 |

| PPP Forgiveness Amount | (Right justified, zero fill to the left) First 8 positions dollar amount.last 2 positions cents | 11 | 53-63 |

| Terminator | \ | 1 | 64-64 |

| Segment Identifier | REF | 3 | 65-67 |

| Separator | * | 1 | 68-68 |

| Purpose Code | ZZ | 2 | 69-70 |

| Separator | * | 1 | 71-71 |

| Purpose Description | PPPFGIVE | 8 | 72-79 |

| Terminator | \ | 1 | 80-80 |